DISCOVER

AXIS CAPITAL

Driven by people

Defined by excellence

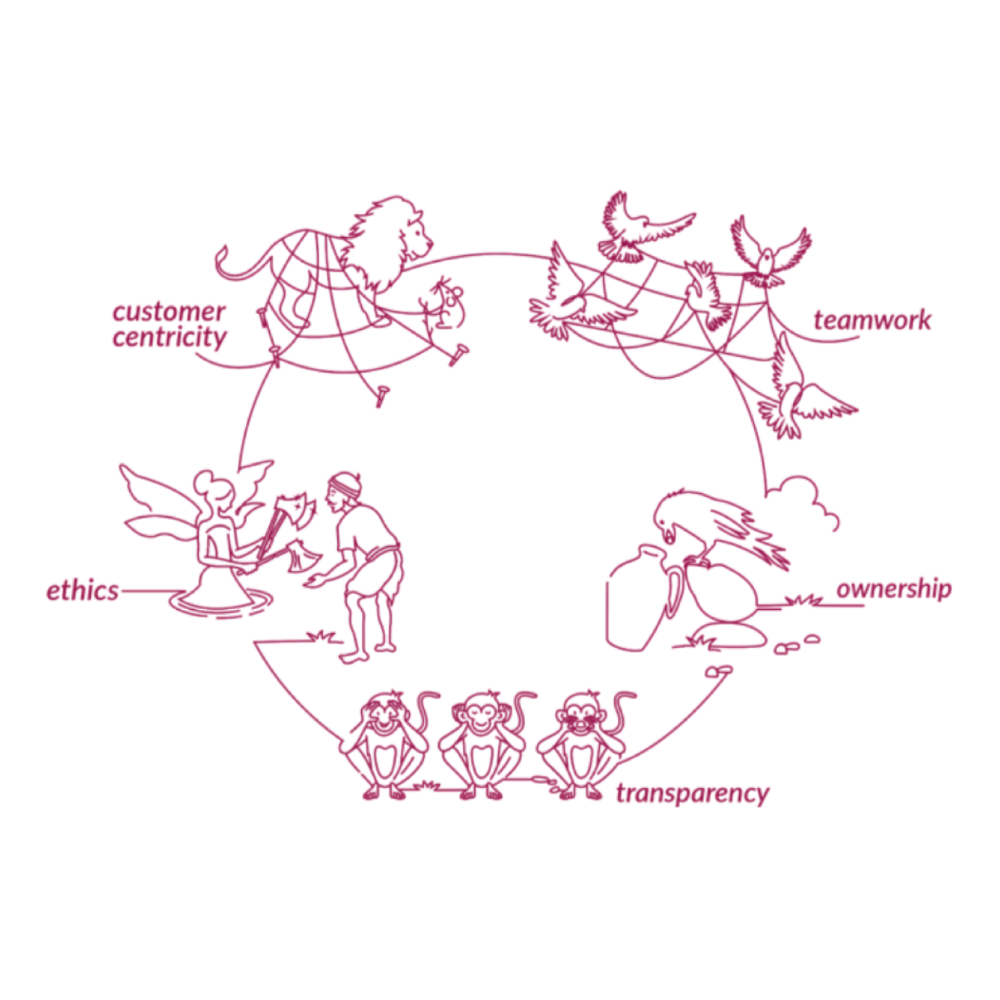

Guided by Values

Our values are a part of everything built here including careers.

Equal Opportunity Employer

We are committed to providing equal employment opportunities, ensuring a fair and supportive for all

Competitive

Competitivesalary

Medical

Medicalbenefits

Maternity,

Maternity,Paternity &

Adoption leave

Well-being

Well-being

Our Pride

Our employees agree – this is a great place to work

Axis Capital has provided a phenomenal platform since I joined. I am fortunate to work with a team that supports me like a family and pushes me to grow every day. From executing multiple InvIT to PE transactions, the learning curve here has been steep and rewarding. I do not think I could have received this breadth of exposure at any other IB.

I enjoy the trust, autonomy and guidance of my leaders which has made my learning curve very steep. I am grateful to Axis Capital for playing such an integral role in my career, helping me grow by honing my skills and giving me the confidence needed to represent the firm internally and externally. I am sure my journey ahead with Axis Capital will be as exciting as it has been so far.

Axis Capital has consistently emphasized client-centricity and deep market expertise. From the very beginning, the team empowered me to engage meaningfully with institutional investors and deliver actionable solutions. The organization operates as a well-integrated network, fostering a synergistic approach to stakeholder value creation. I am excited about building a long and fulfilling career at ACL.